Portfolio Companies

- Portfolio Companies

- Realized Investments

- CASE STUDY(ACT-ONE Yamaichi / Decollte HD / MARKTEC)

CASE STUDY

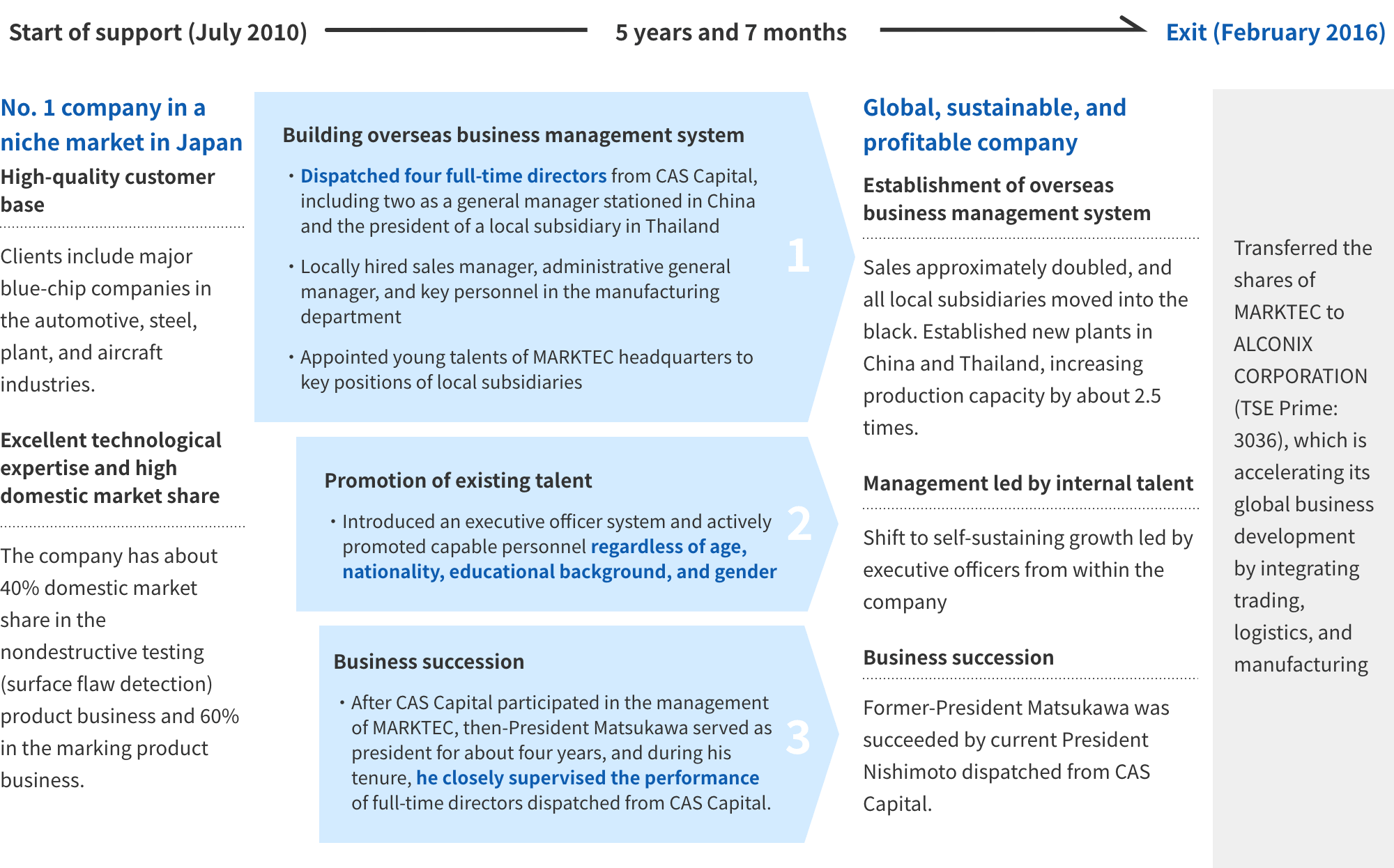

[Support for overseas expansion]

Strengthening business operations in Asia to become

the overwhelming No. 1 global player

Why did you join MARKTEC Corporation as a professional management dispatched by CAS Capital?

Our strength is that we have the top share in the domestic markets for nondestructive testing products and printing/marking products although both of them are niche business. We have a solid business model based on the combined sale of equipment and consumables, such as flaw detection agents and paint, having been in black for nearly 70 years since our foundation. I was interested in participating in the management of MARKTEC on the premise of business succession, as well as its global business strategy targeting mainly Asia, so I thought that this would be a good opportunity for me.

What efforts did you make during the period when CAS Capital invested in MARKTEC?

I aimed to utilize as many young talents as possible from within the company. I have introduced an executive officer system, but rather than immediately appointing them to executive officers, I selected executive officer “candidates” and evaluated their performance for one year before appointing them. As a result, some of them were excluded from the candidate list, but I created a system that encourages friendly competition among candidates by reviewing their performance and replacing them every year. I transferred as much authority as possible to those who became executive officers and encouraged them to actively make proposals and devise good measures without being bound by precedent. I also contacted people who had unfortunately left the company in the past and invited them back, saying, “Now that we have a new management structure, would you work together again?” I introduced a culture in the company that allows people to come back even if they quit.

Regarding a personnel evaluation system, I introduced a system in which organizational goals set at the beginning of the term are broke down into individual goals. Until then, employees had a sense of unclearness about how their evaluations are being conducted. So, I “visualized” the evaluation process from the perspective of fairness and transparency, and as a result, I have been able to build a relationship of trust with managers and employees. I also proceeded with the creation of corporate vision and code of conduct. Specifically, we launched a company-wide project called “Reformation of the MARKTEC Group Corporate Culture Toward a Centenarian Company,” which helped foster a sense of unity among employees.

Please tell us about difficulties or memorable events you experienced at the time.

When I joined the company, the former chairman, who was the original owner of the company, was in office, so I took extra care in communicating with him and proceeded with everything after listening to his opinions. Since I have a background in financial institutions, I am accustomed to dealing with banks and securities firms. So, I was able to successfully carry out the finance and accounting management, which I was in charge of in the administration department at the beginning in the company, and this helped me gain trust within the company. After that, I was also put in charge of plant management. Due to having no technical background, I had to put extra effort into adapting to the community of relevant staff. I also introduced a coaching system into the company as a measure to improve the motivation of executives and employees, conducting one-on-one interviews with all employees. Although employees may have felt nervous at first, the management team actively incorporated their opinions in company policies, which helped foster a relationship of trust within the company.

What was it like working with CAS Capital?

First, I thoroughly learned that “purpose” and “objective” are different concepts from each other. While “objective” is a temporary step, “purpose” is the concept that companies contribute to society by providing unique products and services to customers and making them happy, which is the essence of business, as Peter F. Drucker said, “The purpose of companies is to create customers.” The investment policy of CAS Capital is to “make strong companies stronger” in terms of this essence, so I experienced many things in the process of putting this policy into practice. Mr. Kawamura, the representative of CAS Capital, told me from time to time, “Aim to be the best you can be, and aim to be the best organization and company MARKTEC can be.” To this end, I consciously, thoroughly, and continuously tried to accumulate small efforts that would please our customers.

I also promoted “visualization” with the members of CAS Capital. Specifically, we were able to visualize new product development themes, the status of inquiries and quotations for machinery and equipment, the progress of machinery and equipment projects for which we have received orders, cost control, and expected utilization rate of the production capacity of machinery and chemical products, which I think was significant. I strongly recognized that CAS Capital is an investment fund company that takes a long-term investment approach in which it participates in hands-on management and patiently nurture talent within investee companies.

What do you expect from CAS Capital in the future?

CAS Capital is an investment fund company that seriously aims to strengthen investee companies and moving them on to the next stage. I hope that it will follow through on this vision and contribute even more to solving social issues. This is because there are many small and medium-sized companies in Japan that cannot draw a vision for the future due to lack of successors despite having a solid business model and I believe that the existence of buyout funds that can accelerate the growth of such companies toward the next stage while maintaining their brands and employment are indispensable to society.

What are your current duties and responsibilities at MARKTEC Corporation?

I am in charge of supervising the management of the Machinery Department, which designs and manufactures custom-made machines for non-destructive inspection and printing/marking as our core products, and the R&D Department, which develops new products in our core business fields as well.

In addition, I also serve as the general manager of one of our overseas subsidiaries, Marktec China Corporation.

What was the atmosphere of the company like during the period when CAS Capital made investment in it?

I left MARKTEC in 2008 and returned to the R&D Department, the same workplace as before, in 2014, when CAS Capital was supporting the management of the company. Before I decided to return to the company, CAS Capital explained to me the weaknesses and issues analysis sheet that it created based on the number of man-hours spent on R&D work. The analysis was consistent with my recognition and I felt CAS Capital’s passionate desire to solve those issues, which was the main reason why I decided to return to the company.

When I returned to the company, four years had passed since CAS Capital had invested in it. MARKTEC had established factories in Thailand and China (Shanghai) on its own and was developing its business on a global scale. I still remember that I was amazed and motivated by its quick transformation from a company with closed corporate culture into that with global operations. I also felt firsthand that the company as a whole was being revitalized due to the active promotion of young talents to key positions and the increased opportunities for them to take on new challenges.

What was it like working with CAS Capital?

CAS Capital incorporates the opinions of employees, no matter what their positions are, as long as the opinions are reasonable and correct, and it also addresses any bad practices head-on that have become customs over the years by changing the fundamental mindset of all employees. These efforts of CAS Capital made me feel a sense of unity as a team that transcends the boundary between an investment company and an investee company.

And even now, when we are unsure of our decisions, the mindset change and the code of conduct that we worked on together with CAS Capital at that time underpin our decision making.

What do you expect from CAS Capital in the future?

There are many companies that provide high-quality products and services but are unable to be proactive about investment risks due to having no experience in overseas business operations or have difficulty in continuing their business due to weakened management.

I hope that CAS Capital will support as many such companies as possible so that they can grow into companies that allow employees to have hopes and expectations for the future.

What are your current duties and responsibilities at MARKTEC Corporation?

I am in charge of the management of our global sales, focusing on sales and marketing activities for products related to non-destructive testing and printing/marking, both of which are our core business fields. In the past, I served as the president of a subsidiary in Thailand, and I am still a director of the Thai subsidiary.

What was the atmosphere of MARKTEC like during the period when CAS Capital made investment in it?

Until CAS Capital participated in the management of MARKTEC, I had spent my whole career in sales, mainly for customers in eastern Japan. After CAS Capital’s investment in MARKTEC, I was given the opportunity to take on the challenge of overseas sales. Amid the time when the company as a whole was making a major shift to overseas business, I worked mainly in Indonesia and South Korea and was able to win a historic large order from South Korea’s Hyundai Steel. After that, I was assigned to Thailand and took on the important responsibility of being the president of a local subsidiary, which gave me the opportunity to practice business management as a president for the first time.

At the time, I was conflicted about participating in overseas sales and being the president of a local subsidiary despite my lack of English proficiency. Since I had spent my whole career in sales, it was very difficult and perplexing for me to make decisions about duties that I had no experience in, such as general affairs, human resources, accounting, manufacturing, quality assurance, development, and ISO management. However, looking back, I think it was a very good experience. I also believe that I have been able to develop abilities that I did not know I had.

What was it like working with CAS Capital?

I started my career in overseas business at the same time as CAS Capital made investment in MARKTEC. What was very surprising was the speed and borderlessness of the work performed by CAS Capital. “Work can be done anywhere. Speed is the lifeblood of information.” CAS Capital’s reporting speed and thorough practice of this policy were amazing.

As a result, decision making at the top of organizations has become faster, which enabled quick action at the bottom of organizations. I fully recognized that this sense of speed is essential to compete in the global market.

I was also selected as an executive officer under the executive officer system introduced by President Nishimoto, and I think that selecting the right person for the right job regardless of seniority was very effective in revitalizing our organization.

What do you expect from CAS Capital in the future?

I hope that CAS Capital will continue to pursue its corporate mission of fostering managers in Japan, especially young management talent. I think that there is an overwhelming shortage of management personnel in Japan.

I am also trying to help nurture managers who will lead the next generation in my small way although I am only halfway through the process.