Portfolio Companies

- Portfolio Companies

- CASE STUDY(ACT-ONE Yamaichi / Decollte HD / MARKTEC)

CASE STUDY

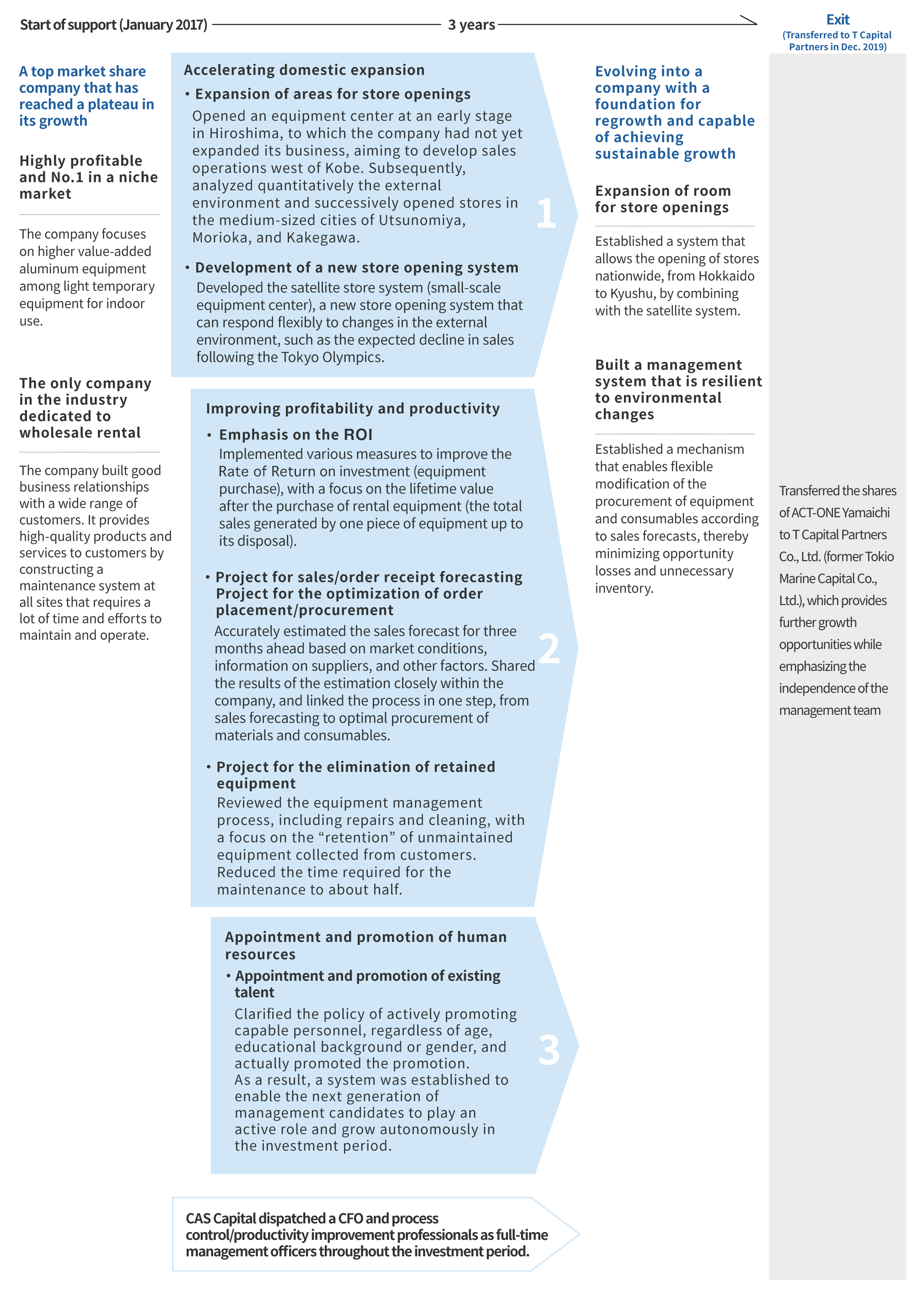

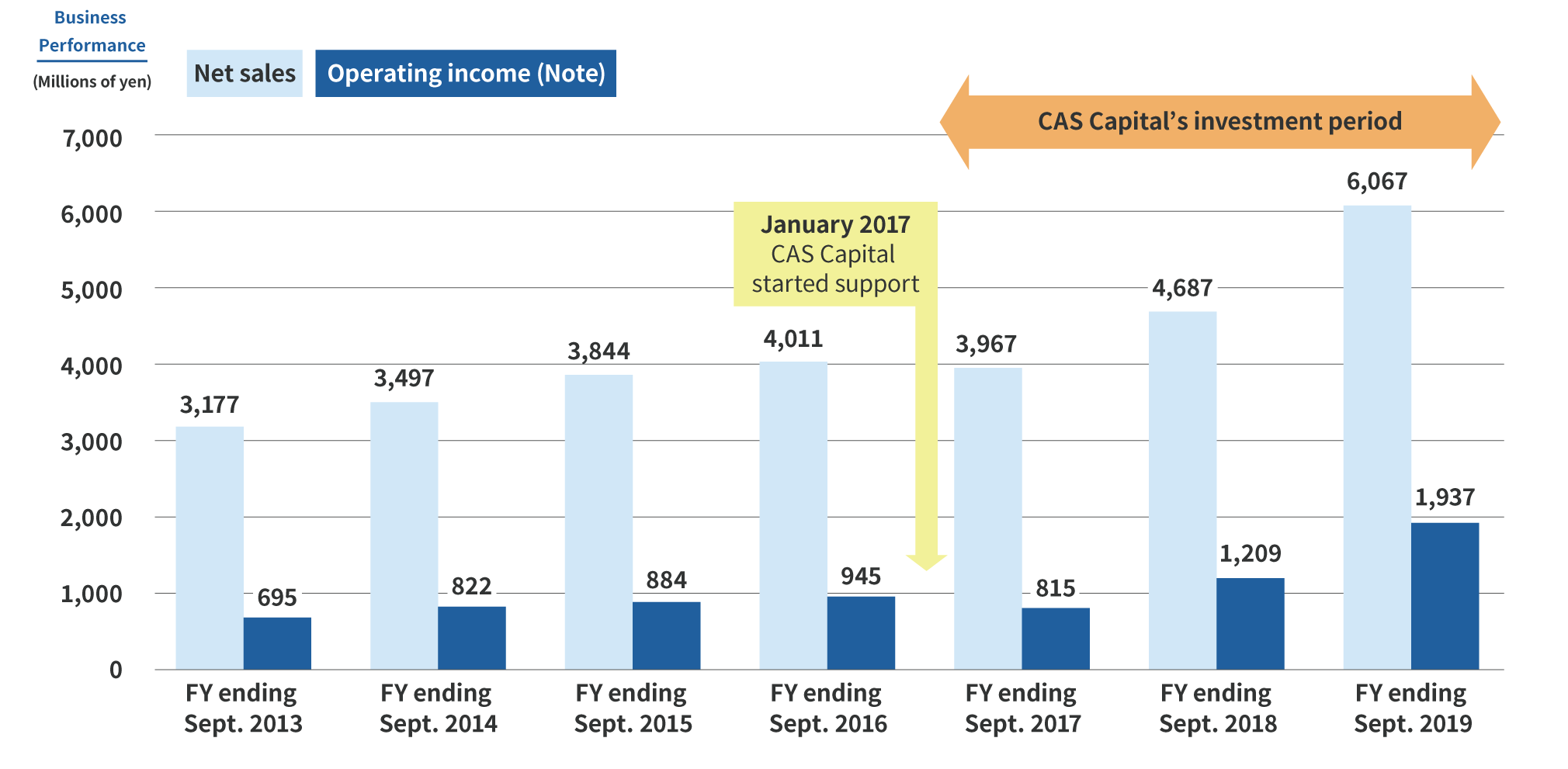

[Supporting the re-growth of mature company] Accelerating growth while respecting autonomy and strengthening the management system

Tell us how you came to consider the transfer of shares.

Watanabe

At that time, I was working as an accountant at an auditing firm, but my uncle, the founder of ACT-ONE Yamaichi, became sick, and I took over the management in 1994 by his wish. I felt a strong sense of responsibility "As long as I am in this position, I had to make sure that all 150 employees are happy with their work.

Watanabe

On the other hand, after assuming the position of president, I knew my own competence as president was not that high and I felt that it would be difficult for me to grow the Company further on my own. In addition, since I was not the founder of the company, I did not have that strong commitment to my company that the founding families would have. From my experience working as an accountant, I knew that there were very talented people in the world, people with excellent management skills. I was wondering if I could benefit from such outside wisdom and bring them to the company. If a stock transfer was necessary to take the company from "Good" to "Great," I was willing to do so with no hesitation.

On the other hand, after assuming the position of president, I knew my own competence as president was not that high and I felt that it would be difficult for me to grow the Company further on my own. In addition, since I was not the founder of the company, I did not have that strong commitment to my company that the founding families would have. From my experience working as an accountant, I knew that there were very talented people in the world, people with excellent management skills. I was wondering if I could benefit from such outside wisdom and bring them to the company. If a stock transfer was necessary to take the company from "Good" to "Great," I was willing to do so with no hesitation.

Your experience outside the company influenced the transfer of shares to a third party. Did you not have a particular preference for business succession within your family?

Watanabe

As I mentioned, I was invited by my uncle to become the president, but he had a son, who was working in the company as a director at the time. As the company’s business conditions deteriorated due to the bursting of the bubble economy, my uncle lost confidence and his health was failing. However, his son was still in his 20s and was not ready to be entrusted with the presidency of the company. Since I was 41 at that time, and had an experience as accountant, I think my uncle wished that I would become the president first, and then pass the position on to his son.

Looking back, it was very good that my uncle started the business during the period of rapid economic growth, but he was not prepared to hand over the presidency to his son. After I became the president, there was a time when our business performance temporarily fell in April 2000. At that time, I retired from the position of the president and became the chairman, and my uncle's son took the position of the president, at the request of my uncle and his wife. I think his son was pushing himself a lot too much because he wanted to live up to his parents' expectations. Eventually, he had a physical breakdown and was unable to come to work after about six months. After that he was not able to work full time and passed away at the age of 50. I wish if he had made it clear to his parents that it was too much for him to hold the position of president, but I think he was notable to say so out of kindness. It would be desirable if there is a competent person in the family, but forcing someone to take on the position of the president even in the absence of such a person could lead to unfortunate results.

Tell us how you came to accept CAS Capital as a shareholder.

Watanabe

From around 2015, I began to consider M&A with other companies or working with funds for further growth. In exploring various options, Mr. Komiya, a representative of Komiya Consultants, introduced me to Mr. Kawamura, a representative of CAS Capital. In discussions with Mr. Kawamura, I strongly identified with his and his team members' honest personalities and their attitude of sincerely thinking about the growth of companies.

CAS Capital’s concept of “creating a strong company” was precisely what I was aiming for. Since I agreed with their concept of not simply pursuing size and aiming to create a “large company” but rather a “strong company” and raising corporate value to turn the company from “good” to “great,” I decided to partner with CAS Capital in 2016.

Why did you join ACT-ONE Yamaichi as a member of the integration team dispatched from CAS Capital?

Yamashita

The moment I heard about ACT-ONE Yamaichi from Mr. Kawamura, I thought, “I didn't know there was such a good company. I would love to have a chance to work with them.” I was impressed when I participated in interviews and due diligence to feel the atmosphere on site, and Mr. Watanabe told me about the ROI (Note), which is the most important KPI of ACT-ONE Yamaichi, and its use.

The moment I heard about ACT-ONE Yamaichi from Mr. Kawamura, I thought, “I didn't know there was such a good company. I would love to have a chance to work with them.” I was impressed when I participated in interviews and due diligence to feel the atmosphere on site, and Mr. Watanabe told me about the ROI (Note), which is the most important KPI of ACT-ONE Yamaichi, and its use.

After discussions in interviews, I realized that there were some points that CAS Capital could be of some assistance to ACT-ONE Yamaichi in terms of its further growth.

The first point is an improvement in the ROI. The ROI was already very high at the time, but there was still room for improvement in the inventory turnover rate of equipment, and I thought by improving the rate, we could further increase the ROI.

The second point is the sales forecasts. I thought that accurate sales forecasts would be necessary in order to have the equipment available to meet future demand. I proposed a policy and plan after the investment in the belief that improving these two points will further improve the corporate value of this company.

(Note) “Rate of return on investment” is the rate of rental fee sales to the amount of investment in the equipment held by the company.

Mizumachi

In January 2017, CAS Capital and ACT-ONE Yamaichi entered into a share transfer agreement and were looking for a new CFO. Since my previous job was completed and I was searching for my next career, I applied for the position.

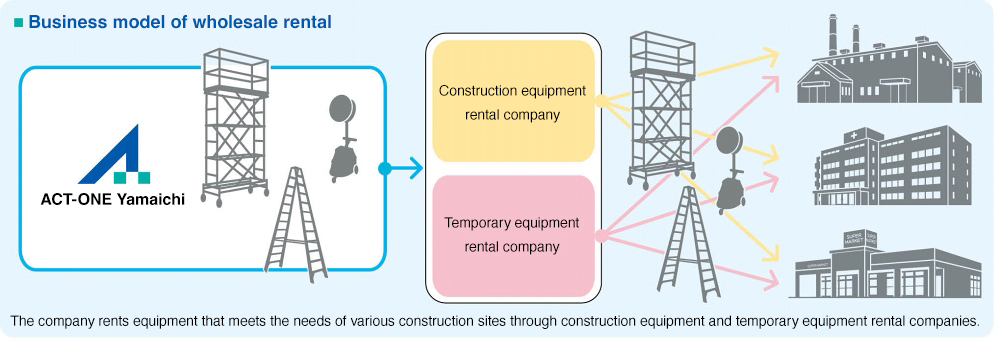

Through the interviews with the members of ACT-ONE Yamaichi and the tour of its stores, I was able to learn firsthand about the excellence of the company's employee training. In addition, I remember well that I was very surprised by its business model that boasts high profit margins.

I was also very surprised when, as the CFO recruitment process progressed, CAS Capital told me that there were several other CFO candidates. At the same time, however, I sympathized with their commitment to choosing a better CFO as a shareholder. I knew some funds from my experience in my previous job, but I had never known any fund that was so careful in choosing a CFO.

I decided to join ACT-ONE Yamaichi because I thought it would be a good opportunity to be able to act as a CFO of an excellent company, together with an investment fund that was careful and thorough in its approach.

How was the reaction of employees to management officers dispatched from the Fund?

Watanabe

I told the employees that we cannot grow into the next stage without the wisdom from outside. I said to them, “You may hear a lot of different things from different angles from those you have heard before, but they are all for the sake of raising the level of the company. Let's accept them and do our best.”

There is one memorable event. CAS Capital's investment was made in Jan 2017, but in April, we actually posted an operating loss on a monthly basis. I expected to some extent that in April, profits might drop considerably, or even go into the red, since depreciation was increasing as we bought a lot of equipment in preparation for the Tokyo Olympics, and sales would drop in the early spring. However, when I saw the magnitude of the reaction of CAS Capital to the deficit, even if it was only for a single month, I was surprised and deeply regretted my stance. It was an event that caused me to change my mindset and straighten up my attitude.

In addition, I am still grateful to Mr. Kawamura for giving me an opportunity to spend about an hour to talk about the rental business at the first BOD meeting we had with CAS Capital. For my part, I wanted to let CAS Capital know what we have been doing, and CAS Capital showed itself a willingness to listen.

Yamashita

I remember very well what Mr. Watanabe said at that meeting. Beginning with “how rental and leasing differ,” I was able to understand the principles of the rental business and our strengths, and gained an insight into the essential ideas that form the basis for working together to implement measures to increase value in the future. I learned an important lesson, how to create value for customers.

Please tell us the specific four issues in the process of aiming for advance from “good” to “great”: “opening new stores,” “development and handling new equipment,” “improvement of productivity,” and “development of human resources.”

Watanabe

I became more aware of these four issues through discussions with CAS Capital. If I had not been engaged with CAS Capital, I might not still have been able to accurately recognize them.

Regarding the opening of new stores, we proactively opened new stores by making our positioning clear to rental companies, which are our customers, that we are a wholesaler and a “supporter rather than a competitor.” In addition to the opening of conventional stores, we have also developed a new type of store opening, the satellite store system (Note), which allows us to reduce capital investment and respond flexibly to changes in the environment.

Watanabe

Regarding the development of new equipment, we have long been working with manufacturers to develop products, but we have come to seriously consider what we can provide to manufacturers. By communicating the know-how we have gained through maintenance to manufacturers, we have become able to develop easy-to-use products tailored to each site. It has helped us to be much more aware of our own strengths.

Regarding the development of new equipment, we have long been working with manufacturers to develop products, but we have come to seriously consider what we can provide to manufacturers. By communicating the know-how we have gained through maintenance to manufacturers, we have become able to develop easy-to-use products tailored to each site. It has helped us to be much more aware of our own strengths.

When it comes to productivity, I have to admit that I had previously been a little naive about the low inventory turnover. However, by looking at the numbers again with Mr. Yamashita and Mr. Mizumachi, I felt a sense of crisis. Since the participation of CAS Capital, the inventory turnover of equipment has finally improved significantly. I am very grateful for bringing our attention to the inventory turnover.

As for human resources, it is a really difficult issue. First of all, it would be difficult unless the thoughts of the company and employees match. Recruitment is very important. No matter how much we convey our thoughts, some people don’t understand them. Also, it is not enough to enhance the training system, but it is important to have people who can put what they have learned into action on their own.

(Note) The “satellite store system” is a smaller equipment center than conventional ones that can be operated with three or fewer people.

Yamashita

I considered the opening of new stores as an extension of productivity. When I think about how to make people of ACT-ONE Yamaichi happy, it all comes down to “increasing productivity,” or in the case of the equipment rental business, “getting the equipment to work and not letting it lie idle.”

One of the timings when “equipment lies idle” was at the time of the opening of new stores. In the case of the opening of completely new stores, it is difficult in reality to immediately start up sales outlets and have equipment in full utilization, but growth will stop if you take a wait-and-see approach and don’t open new stores. In this context, the satellite store system was very reasonable.

If a sales area is within reach from existing stores, you know the situation well, and thus you can see the demand, the specific timing and volume of equipment utilization, and equipment can be accommodated among neighboring stores. Based on this idea, the opening of stores under a satellite store system, whose scale is smaller than conventional ones, with other stores in the vicinity, and considering the area as a “surface” will further increase the utilization rate of equipment. This is also an idea that came from the concept of “not letting equipment lie idle” and was born out of the lesson on the rental business learned from Mr. Watanabe.

The first store under the satellite store system in Utsunomiya immediately recorded a surplus, which made me convinced that this was a new winning pattern for ACT-ONE Yamaichi. Since this store opening was based on an idea that resulted from all employees putting their heads together, it is very memorable.

Yamashita

As for human resources, Mr. Watanabe had developed excellent human resources, allowing us to focus on “producing results” together with those people. Usually, one measure is taken at a time at an investee company, but in the case of ACT-ONE Yamaichi, the level of human resources was extremely high, and we were able to implement multiple measures simultaneously from the beginning and generate more and more results, which was an unprecedented and great experience for me.

As for human resources, Mr. Watanabe had developed excellent human resources, allowing us to focus on “producing results” together with those people. Usually, one measure is taken at a time at an investee company, but in the case of ACT-ONE Yamaichi, the level of human resources was extremely high, and we were able to implement multiple measures simultaneously from the beginning and generate more and more results, which was an unprecedented and great experience for me.

Mizumachi

As a CFO, I was responsible for making a future forecast of each store, but in the latter half of the investment period, each store grew to the point where they could make forecasts about equipment and profits on its own. For example, a major factor behind our growth is the fact that we have become able to engage in active internal discussions and promptly put them into actions regarding various issues, such as whether to move this equipment to this store or purchase it because it is insufficient, or whether to plan the opening of new stores because construction demand is strong in this area, and whether the conventional store or the satellite store system is better in such a case.

One symbolic episode is the story about the Nagoya Office. Nagoya is located in the middle of the east and west of Japan, which had tended to cause cases where it was unclear where responsibility lies among sales departments in the east and west regions, resulting in a high equipment retention rate. To address this situation, people in charge in the east and west regions spontaneously consulted with each other and began to voluntarily allocate the retained equipment in Nagoya between the east and west regions and willingly maintain it. Continuous reduction of retained inventory requires continuing to perform very modest tasks, such as cleaning and repairs. I was surprised when I heard about it and thought that something amazing was happening.

With regard to human resources, many of the employees of ACT-ONE Yamaichi are very hard working, but through individual interviews with all employees, I realized that middle-level employees were actually becoming tired. Accordingly, we conducted interviews with all employees once a quarter, based on which we created a detailed notes and shared it with Mr. Watanabe to discuss countermeasures. From such discussions, we developed a new career plan system, such as a sub-chief system. I still remember each face and names of employee, and I had a very fulfilling time with them.

Yamashita

What happened in Nagoya is really an unforgettable event. While the equipment retention rate for the entire company was about 11%, it was about 23% only in Nagoya at that time. The members on site came up with an idea to deal with this problem. If the staff in other sites provide assistance for Nagoya, their own sites would be understaffed and the retention rate would deteriorate, but I was very pleased and impressed that they took a risk to do so for the company. It was a milestone event in which as a result, the overall retention rate also improved significantly.

In addition, CFO Mr. Mizumachi presided over the forecast meeting, which is a sales meeting. As internal employees suggested a variety of measures while looking at sales forecasts and other figures at that meeting, Mr. Mizumachi made a great contribution to the improvement of profitability.

How was it working with CAS Capital?

Watanabe

I think the way CAS Capital works is the real hands-on approach that a company wants. They worked together on-site to manage the company, and also sent us very talented people. I think there are few funds that actually perform or able to perform their work to this extent. The real hands-on approach that a company wants is not something that can be implemented easily even if you try to. CAS Capital is capable of implementing such an approach, and I hope that they will continue to maintain.

(Note) Operating income before amortization of goodwill